Bookkeeping and accounting are essential functions for any business, big or small. However, managing these functions manually can be time-consuming and prone to errors. Fortunately, there are numerous software options available to streamline these processes and help businesses stay organized.

Two of the most popular bookkeeping and accounting software options available are QuickBooks and Xero. While both software programs offer similar features and benefits, they differ in several key areas that may make one more suitable than the other depending on the needs of your business.

In this article, we’ll provide an in-depth comparison of QuickBooks vs Xero, covering everything from key features and pricing plans to user experience and customer support. By the end of this guide, you should have a better understanding of which software may be the best fit for your business needs. So, let’s dive in and explore the differences between Quickbooks and Xero.

Introduction to QuickBooks

QuickBooks is a bookkeeping and accounting software developed and marketed by Intuit, a company that has been a leading provider of financial software solutions for over three decades. Quickbooks is designed to help small and medium-sized businesses manage their finances more efficiently, with tools and features to automate bookkeeping tasks and provide real-time insights into their financial performance.

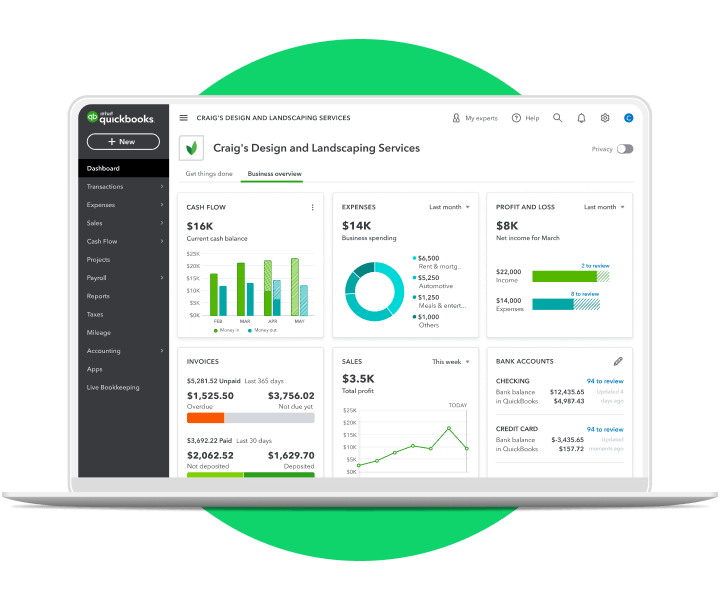

QuickBooks has come a long way since its early days as a desktop accounting software. Today, the software has almost completely transitioned to QuickBooks Online, a cloud-based solution that offers users more flexibility and convenience in accessing their financial data from anywhere with an internet connection. The latest version of QuickBooks Online also provides a better user experience with an updated and modernized interface that’s intuitive and easy to use.

QuickBooks offers a wide range of features and benefits for businesses, including invoicing, expense tracking, payroll processing, and inventory management. The software also provides robust reporting and analytics features that allow businesses to gain valuable insights into their financial health and make informed decisions about their operations.

In recent years, QuickBooks has continued to add new features and integrations to its software, making it a versatile option for businesses of all sizes. QuickBooks integrates with hundreds of other business tools and apps, such as payment processors, CRM software, and project management tools, allowing businesses to streamline their workflows and save time on manual data entry.

While QuickBooks may be more expensive than some other accounting software options, it offers a comprehensive set of features and benefits that can save businesses time and money in the long run. However, new users may find that there is a steep learning curve when first getting started with the software.

Here’s a closer look at what QuickBooks has to offer:

Key Features and Benefits

- Invoicing: QuickBooks makes it easy to create and send professional invoices to customers. You can customize invoices with your company logo, set up recurring invoices, and track payments.

- Expense Tracking: QuickBooks allows you to easily track business expenses by connecting to your bank accounts and credit cards. You can categorize expenses, add receipts, and run reports to see how your money is being spent.

- Inventory Management: QuickBooks offers basic inventory management features that allow you to track products, set reorder points, and create purchase orders.

- Payroll: QuickBooks has a built-in payroll processing feature that allows you to manage employee wages and taxes. You can also file payroll taxes and generate W-2s and 1099s.

- Reporting and Analytics: QuickBooks provides a range of reporting and analytics features that allow you to monitor your business’s financial health. You can run profit and loss reports, track sales and expenses, and create custom reports.

Pricing Plans

QuickBooks offers several pricing plans, including:

- Simple Start: $30 per month

- Essentials: $55 per month

- Plus: $85 per month

- Advanced: $200 per month

Each plan offers different features and benefits, so you can choose the plan that best fits your business needs.

One way businesses can save money on QuickBooks is to sign up through a Certified QuickBooks Solutions Partner. BooXkeeping is a QuickBooks Strategic Silver Partner and Certified QuickBooks Solutions Provider. Users who sign up for QuickBooks through BooXkeeping can take advantage of special discounted pricing and get access to the latest updates, so they get the most from their QuickBooks subscription.

Pros and Cons of Using QuickBooks

Pros

- Easy to use: QuickBooks has a user-friendly interface that makes it easy to navigate and manage your finances.

- Robust features: QuickBooks offers a wide range of features that cover most small business accounting needs.

- Integrations: QuickBooks integrates with hundreds of other business tools and apps, making it a versatile option.

- Customer support: QuickBooks offers several customer support options, including phone, chat, and email.

Cons

- Expensive: In a head-to-head comparison of QuickBooks vs Xero, QuickBooks can be more expensive than other accounting software options, especially for businesses that require more advanced features.

- Limited customizability: QuickBooks doesn’t offer as much flexibility for customizing invoices, reports, and other features as some other software options, like Xero.

- Steep learning curve: When comparing QuickBooks vs Xero, QuickBooks can be complex and take some time to learn for new users.

Quickbooks is a Versatile, Efficient Accounting Software and a Solid Choice for Most Businesses

Overall, Quickbooks is a solid choice for most businesses of any size and industry. Whether you’re a small business owner or a franchisor with multiple locations, Quickbooks has the tools and features you need to manage your finances more efficiently. With its wide range of features, integrations, and pricing plans, Quickbooks offers businesses the flexibility to customize their accounting software to fit their unique needs. While the software can be complex and take some time to learn for new users, it offers a comprehensive set of features and benefits that can save businesses time and money in the long run.

Introduction to Xero

Xero is a cloud-based accounting software designed to help small and medium-sized businesses manage their finances more efficiently. While Xero hasn’t been around as long as QuickBooks, it has definitely earned its place in our QuickBooks vs Xero comparison. Founded in New Zealand in 2006, Xero has since expanded to become a global leader in cloud accounting, with over 2 million subscribers in more than 180 countries.

One of the reasons for Xero’s success is its dedication to continuous improvement. Xero is committed to enhancing its software through regular updates and new features. In fact, the company releases over 500 product updates each year, ensuring that its users have access to the latest technology and accounting best practices.

Xero’s dedication to innovation is reflected in its user-friendly interface and intuitive design. The software is easy to navigate and provides users with real-time access to their financial data, allowing them to make informed decisions about their business operations.

With its broad range of features, including invoicing, expense tracking, payroll processing, and inventory management, Xero is a versatile option for businesses of all sizes. The software also provides robust reporting and analytics features that allow businesses to gain valuable insights into their financial performance.

Overall, Xero is a reliable and efficient option for businesses looking to streamline their accounting processes and stay on top of their finances.

Here’s a closer look at what Xero has to offer:

Key Features and Benefits

- Invoicing: Xero makes creating and sending professional invoices to customers easy. You can customize invoices with your company logo, set up recurring invoices, and track payments.

- Expense Tracking: Xero allows you to easily track business expenses by connecting to your bank accounts and credit cards. You can categorize expenses, add receipts, and run reports to see how your money is being spent.

- Inventory Management: Xero offers basic inventory management features that allow you to track products, set reorder points, and create purchase orders.

- Payroll: Xero has a built-in payroll processing feature that allows you to manage employee wages and taxes. You can also file payroll taxes and generate W-2s and 1099s.

- Reporting and Analytics: Xero provides a range of reporting and analytics features that allow you to monitor your business’s financial health. You can run profit and loss reports, track sales and expenses, and create custom reports.

Pricing Plans

Xero offers several pricing plans, including:

- Early: $13 per month

- Growing: $37 per month

- Established: $70 per month

Each plan offers different features and benefits, so you can choose the plan that best fits your business needs. When comparing QuickBooks vs Xero, the latter is most certainly the more affordable option of the two.

As a Certified Xero Silver Partner, BooXkeeping provides expert guidance to businesses that run on Xero, ensuring that they’re using the software to its full potential. Users who sign up for Xero through BooXkeeping also get access to discounted pricing, making Xero an even more affordable option for businesses.

Pros and Cons of Using Xero

Pros

- Affordable: Xero can be more affordable than other accounting software options, especially for businesses that require basic features.

- Easy to use: Xero has a user-friendly interface that makes it easy to navigate and manage your finances.

- Robust features: Xero offers a wide range of features that cover most small business accounting needs.

- Integrations: Xero integrates with over 800 other business tools and apps, making it a versatile option.

Cons

- Limited customizability: Xero doesn’t offer as much flexibility for customizing invoices, reports, and other features as some other software options.

- Customer support: While Xero offers customer support options like phone and email, some users have reported difficulty getting timely responses.

- Limited inventory management: While Xero offers basic inventory management features, they may not be sufficient for businesses with complex inventory needs.

Quickbooks vs Xero – Features Comparison

When it comes to bookkeeping and accounting software, Quickbooks and Xero are two of the most popular options on the market. Both offer a wide range of features and benefits for businesses, but there are some key differences between the two. Here’s a comparison of some of the most important features:

QuickBooks vs Xero – Which Software Offers the Best Invoicing Features?

Both Quickbooks and Xero offer robust invoicing features that allow businesses to create and send professional invoices to customers. However, Xero’s invoicing feature is more customizable, allowing users to create and send invoices with different branding and layout options. Xero also offers an online payment option for invoices, which can help businesses get paid faster.

QuickBooks vs Xero – Comparing Inventory Management Systems

While both Quickbooks and Xero offer basic inventory management features, Quickbooks is generally considered to be the better option for businesses with more complex inventory needs. Quickbooks offers more advanced inventory tracking features, such as the ability to track inventory levels and create purchase orders. Xero’s inventory management feature, on the other hand, is more basic and may not be sufficient for businesses with complex inventory needs.

Bank Reconciliation: QuickBooks vs Xero – Which Software Is More User-Friendly?

Both Quickbooks and Xero offer bank reconciliation features that allow businesses to reconcile their bank accounts with their accounting records. However, Xero’s bank reconciliation feature is more user-friendly, with a simple and intuitive interface that makes it easy to reconcile transactions. Quickbooks’ bank reconciliation feature, while still effective, can be more complex and take longer to reconcile transactions.

QuickBooks vs Xero’s Payroll and Tax Features

Quickbooks and Xero both offer payroll processing features that allow businesses to manage employee wages and taxes. Quickbooks has a built-in payroll processing feature that allows businesses to run payroll and file payroll taxes. Xero’s payroll feature, on the other hand, is only available in select countries and requires integration with a third-party payroll provider. When it comes to taxes, both software options provide tax management features to help businesses stay compliant with tax regulations.

QuickBooks vs Xero – Which Software Offers the Most Comprehensive Reporting?

Both Quickbooks and Xero provide a range of reporting and analytics features that allow businesses to monitor their financial health and make informed decisions. Quickbooks offers more advanced reporting features, with over 65 report templates and customizable report options. Xero’s reporting features are more basic, with fewer report templates, but they are still effective and provide valuable insights into a business’s financial performance.

Overall, both Quickbooks and Xero offer robust features and benefits that can help businesses manage their finances more efficiently. However, the specific features and capabilities of each software option may be better suited for different types of businesses and industries.

QuickBooks vs Xero – User Experience and Customer Support Comparison

User Experience and Ease of Use

One of the most important considerations when choosing accounting software is user experience and ease of use. Quickbooks and Xero both have user-friendly interfaces and are relatively easy to navigate. However, Xero is generally considered to have a more modern and intuitive interface, with a simpler design and more streamlined workflows. Quickbooks, on the other hand, can be more complex and take longer to learn for new users.

Customer Support Options and Responsiveness

Another important consideration when choosing accounting software is customer support options and responsiveness. Quickbooks offers several customer support options, including phone and chat support, as well as an extensive knowledge base and community forum. Xero also offers phone and chat support, as well as an online help center and community forum. However, some users have reported longer wait times for Xero customer support compared to Quickbooks.

Overall, both Quickbooks and Xero offer user-friendly interfaces and solid customer support options. However, Xero’s interface is generally considered to be more modern and intuitive, while Quickbooks offers more robust customer support options with shorter wait times. When choosing between the two software options, businesses should consider their specific needs and preferences to determine which software offers the best user experience and customer support for their business.

For businesses that require additional support when using Quickbooks or Xero, working with a certified bookkeeping and accounting partner can be a valuable option. BooXkeeping is a Certified QuickBooks Solutions Partner and Certified Xero Silver Partner, providing businesses with expert guidance and support for both software options. If you’re unsure which software is right for your business or require additional support, contact BooXkeeping for a free consultation and expert recommendation.

QuickBooks vs Xero – Comparing Integrations and Add-ons

One of the benefits of using accounting software like Quickbooks and Xero is the ability to integrate with other business tools and add-ons. Both software options offer a wide range of integrations and add-ons that can help businesses streamline their operations and improve their workflows.

QuickBooks Integrations

Quickbooks offers integrations with over 650 business tools and apps, including popular options like PayPal, Shopify, and TSheets. These integrations can help businesses automate tasks and sync data between different platforms.

Click here for a full list of integrations available with QuickBooks

Xero Integrations

Xero also offers a wide range of integrations with over 800 business tools and apps, including popular options like Salesforce, Stripe, and HubSpot. In addition, Xero offers an add-on marketplace that allows businesses to browse and purchase additional features and integrations, such as expense management tools and payment processing options.

Click here for a full list of integrations available with Xero

How Each Software Integrates with Other Business Tools

Both Quickbooks and Xero are designed to integrate with a wide range of other business tools and apps, making them versatile options for businesses of all sizes and industries. When choosing between the two software options, businesses should consider which integrations and add-ons are most important to their operations and workflows.

For businesses that require integrations with e-commerce platforms or payment processing tools, Quickbooks may be the better option due to its strong integration offerings with tools like Shopify and PayPal.

For businesses that require integrations with marketing or sales tools, Xero may be the better option due to its strong integration offerings with tools like Salesforce and HubSpot.

QuickBooks vs Xero – Comparing the Costs

Overall, both QuickBooks and Xero offer robust integrations and add-ons that can help businesses streamline their operations and improve their workflows. By choosing the software that best integrates with their existing tools and platforms, businesses can improve their efficiency and productivity.

QuickBooks and Xero offer different pricing plans with varying features and capabilities. Here’s an in-depth comparison of the pricing plans and features offered by both software options:

Pro Tip: Bookkeeping and accounting software like QuickBooks and Xero have monthly subscription costs with different price points but almost always charge extra for add-ons like payroll and tax forms.

QuickBooks Pricing Plans & Add-Ons

QuickBooks offers four pricing plans: Simple Start, Essentials, Plus, and Advanced.

- Simple Start: This plan costs $30 per month and includes basic features such as income and expense tracking, invoicing, and receipt capture. It’s designed for very small businesses or self-employed individuals who only need basic accounting features.

- Essentials: This plan costs $55 per month and includes additional features such as bill management and time tracking. It’s designed for small businesses with more complex accounting needs.

- Plus: This plan costs $85 per month and includes more advanced features such as inventory management and project profitability tracking. It’s designed for growing businesses with more complex accounting needs.

- Advanced: This plan costs $200 per month and includes the most advanced features, such as custom user permissions and enhanced custom fields. It’s designed for larger businesses with more complex accounting needs.

What does QuickBooks charge extra for?

QuickBooks charges extra for certain add-ons such as payroll processing, payment processing, and access to their time tracking and inventory management features. They also offer additional services such as bookkeeping and tax filing for an additional cost.

Xero Pricing Plans & Add-Ons

Xero offers three pricing plans: Early, Growing, and Established

- Early: This plan costs $13 per month and includes basic bookkeeping features such as invoicing, expense tracking, and bank reconciliation. It’s designed for very small businesses or self-employed individuals who only need basic accounting features.

- Growing: This plan costs $37 per month and includes additional features such as project management and multi-currency support. It’s designed for small to medium-sized businesses with more complex accounting needs.

- Established: This plan costs $70 per month and includes more advanced features such as expense claims and purchase order management. It’s designed for larger businesses with more complex accounting needs.

What does Xero charge extra for?

Xero charges extra for certain add-ons, such as payroll processing, expense management, and project management. Additionally, Xero has an add-on marketplace where users can browse and purchase additional features and integrations, such as inventory management tools and payment processing options.

When comparing the pricing plans and features of Quickbooks vs Xero, it’s important to consider the specific needs of your business. Both software options offer a range of pricing plans and features to accommodate businesses of different sizes and industries. By carefully considering your business needs and budget, you can choose the software option that best fits your needs and helps you manage your finances more efficiently.

Which Bookkeeping and Accounting Software is Right for Your Business?

Key Takeaways When Looking at QuickBooks vs Xero

When it comes to choosing the best bookkeeping and accounting software for your business, there are many factors to consider. QuickBooks and Xero are two of the most popular options on the market, and both offer a wide range of features and capabilities to help businesses manage their finances more efficiently.

In this comparison guide, we’ve explored the key features, pricing plans, user experience, customer support, integrations, and add-ons offered by QuickBooks and Xero. Here are some key takeaways from our analysis:

- QuickBooks is a more established software option, with a wide range of pricing plans and features to accommodate businesses of all sizes and industries.

- Xero is a newer software option, with a more modern interface and strong integrations and add-ons, particularly for businesses that require marketing or sales tools.

- Both QuickBooks and Xero offer solid user experiences and customer support options, with varying strengths in different areas.

- Both software options offer a range of integrations and add-ons to help businesses streamline their operations and workflows.

Recommendations for Which Software May Be Best for Different Types of Businesses

Ultimately, the best bookkeeping and accounting software for your business will depend on your specific needs and preferences. Here are some recommendations based on our analysis:

- If you’re a small to medium-sized business with basic accounting needs, Xero may be the best option due to its more modern interface and strong integrations with marketing and sales tools.

- If you’re a larger business with more complex accounting needs, QuickBooks may be the better option due to its more established presence and wider range of pricing plans and features.

- If you require additional support when using QuickBooks or Xero, working with a certified bookkeeping and accounting partner like BooXkeeping can provide valuable guidance and support to help you manage your finances more efficiently.

Overall, by carefully considering your business needs and preferences, you can choose the software option that best fits your needs and helps you manage your finances more efficiently.

Advantages of Working with a Certified Bookkeeping Software Partner

BooXkeeping is an outsourced bookkeeping service provider that offers a wide range of solutions to help businesses manage their finances more efficiently. As a Certified QuickBooks Solutions Partner and Xero Silver Partner, BooXkeeping has the expertise and experience to help businesses optimize their use of these powerful software tools.

By working with BooXkeeping, businesses can take advantage of expert guidance and support to help them choose the best software and maximize the value received. To learn more about the differences between QuickBooks vs Xero, contact us today and schedule a free consultation.